Delving into the realm of Accounting Automation Tools That Support Scaling Businesses, this introductory passage sets the stage for a comprehensive exploration of how automation can revolutionize financial management for growing companies.

Highlighting key aspects of the importance of automation and its impact on scalability, this paragraph aims to captivate readers and draw them into the discussion.

Importance of Accounting Automation Tools for Scaling Businesses

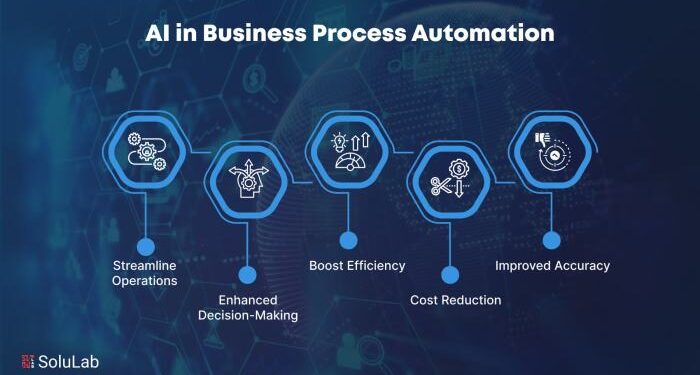

Accounting automation tools play a crucial role in the growth and scalability of businesses by streamlining financial processes and improving efficiency. These tools leverage technology to handle repetitive and time-consuming tasks, allowing businesses to focus on strategic decision-making and expansion.

Streamlining Financial Processes

- Automation tools can automate data entry, invoice processing, and reconciliation, reducing manual errors and saving time.

- By automating routine tasks, businesses can accelerate the financial close process and access real-time financial data for better decision-making.

- Automated reporting features enable businesses to generate accurate financial reports quickly, providing insights into performance and profitability.

Enhancing Efficiency

- Automation tools eliminate the need for manual intervention in repetitive tasks, increasing productivity and freeing up resources for strategic initiatives.

- Efficient workflows and approval processes ensure timely payments and compliance with financial regulations, reducing the risk of penalties or errors.

- Integration with other business systems allows for seamless data flow and collaboration across departments, improving overall efficiency.

Impact on Scalability and Growth

- By automating financial processes, businesses can scale operations without significantly increasing administrative overhead, enabling smoother growth.

- Automation tools provide scalability by adapting to changing business needs and handling increased transaction volumes efficiently.

- Improved accuracy and visibility into financial data support informed decision-making, facilitating strategic planning for sustainable growth.

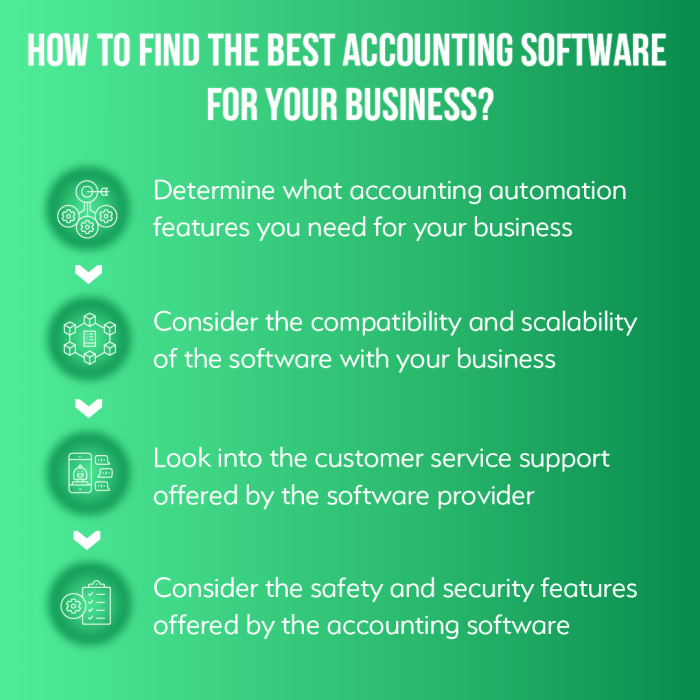

Features to Look for in Accounting Automation Tools

When selecting accounting automation tools to support scaling businesses, it's crucial to consider specific features that can enhance productivity and accuracy in financial management.

Integration with Existing Systems

Look for tools that seamlessly integrate with your current accounting systems and software. This feature ensures smooth data transfer and reduces the need for manual data entry, saving time and minimizing errors.

Customization and Scalability

Opt for tools that offer customization options to tailor the software to your business's specific needs. Scalability is also essential, allowing the tool to grow with your business and handle increased data volumes as your company expands.

Automated Reporting and Analytics

Choose tools that provide automated reporting and analytics capabilities. These features can generate real-time insights into your financial data, enabling you to make informed decisions quickly and accurately.

Data Security and Compliance

Ensure that the automation tool prioritizes data security and compliance with industry regulations. Look for features like encryption, secure data storage, and audit trails to safeguard sensitive financial information.

User-Friendly Interface and Support

Consider tools with a user-friendly interface that is easy to navigate and understand. Additionally, look for vendors that offer comprehensive customer support to assist with any technical issues or questions that may arise.

Integration with Existing Systems

When it comes to accounting automation tools for scaling businesses, integration with existing systems plays a crucial role in streamlining operations and maximizing efficiency.

Optimizing Workflow and Data Management

Seamless integration of accounting automation tools with other existing systems like CRM, ERP, or e-commerce platforms can optimize workflow and data management in various ways:

- Automated data syncing between systems reduces manual data entry errors and saves time.

- Real-time data sharing ensures accurate financial reporting and decision-making.

- Integration allows for a centralized view of business operations, enhancing transparency and collaboration.

Scalability of Business

The ability of accounting automation tools to integrate with existing systems is a key factor in the scalability of a business:

- As the business grows, seamless integration ensures that all systems are working harmoniously without disruptions.

- Integration capabilities enable businesses to easily add new functionalities or expand operations without major system overhauls.

- Efficient data flow between systems supports the scalability of the business by providing a foundation for future growth and adaptation.

Data Security and Compliance Considerations

When it comes to choosing accounting automation tools for scaling businesses, data security and compliance are crucial factors to consider. Ensuring the protection of sensitive financial information and adherence to regulatory requirements is essential in maintaining the trust of customers, investors, and stakeholders.

Significance of Data Security and Compliance

One of the primary reasons why data security and compliance are essential in automated accounting processes is to prevent unauthorized access to confidential information. By implementing robust security measures and complying with regulations such as GDPR, HIPAA, or SOX, businesses can safeguard their data from cyber threats and legal risks.

Furthermore, maintaining data security and regulatory compliance helps businesses build a reputation for trustworthiness and reliability. This can lead to increased customer loyalty and confidence, which are critical for the sustained growth and success of a scaling business.

Best Practices for Ensuring Data Security and Regulatory Compliance

- Implement encryption protocols to protect data in transit and at rest.

- Regularly update and patch accounting software to address vulnerabilities.

- Restrict access to sensitive financial data to authorized personnel only.

- Conduct regular security audits and risk assessments to identify and mitigate potential threats.

Mitigating Risks with Automation Tools

- Automation tools can help reduce the risk of human error in accounting processes, minimizing the chances of data breaches or compliance violations.

- By setting up automated alerts for suspicious activities or anomalies, businesses can quickly detect and respond to potential security incidents.

- Integration with secure cloud storage solutions can enhance data protection and ensure compliance with data privacy regulations.

Conclusive Thoughts

In conclusion, the journey through the significance of accounting automation tools for scaling businesses unveils a landscape where efficiency and growth converge. By embracing these tools, businesses can pave the way for streamlined financial processes and sustainable expansion.

FAQ Compilation

What features should accounting automation tools have for scaling businesses?

Accounting automation tools for scaling businesses should ideally have features like scalability, integration capabilities, data security, and compliance to ensure seamless financial management.

How can automation tools mitigate potential risks for scaling businesses?

Automation tools can mitigate risks by implementing robust data security measures, ensuring regulatory compliance, and offering seamless integration with existing systems to optimize workflow and mitigate potential threats.

![AI in B2B Sales: How It’s Used and Its Biggest Benefits [New Data]](https://digital.haijakarta.id/wp-content/uploads/2025/12/Sales-Automation-Tools-InsightSquared-Salesblink-120x86.jpg)